Antwort Is $100 enough to start investing? Weitere Antworten – Is $100 too little to invest

Investing just $100 a month can actually do a whole lot to help you grow rich over time. In fact, the table below shows how much your $100 monthly investment could turn into over time, assuming you earn a 10% average annual return.Decide on a percentage of your income that you can dedicate to building your portfolio. The general rule of thumb for retirement goals is to invest 15% of your income each year, but if you started investing later in your career or want to retire early you may want to consider investing a higher percentage.“Ideally, you'll invest somewhere around 15%–25% of your post-tax income,” says Mark Henry, founder and CEO at Alloy Wealth Management. “If you need to start smaller and work your way up to that goal, that's fine. The important part is that you actually start.”

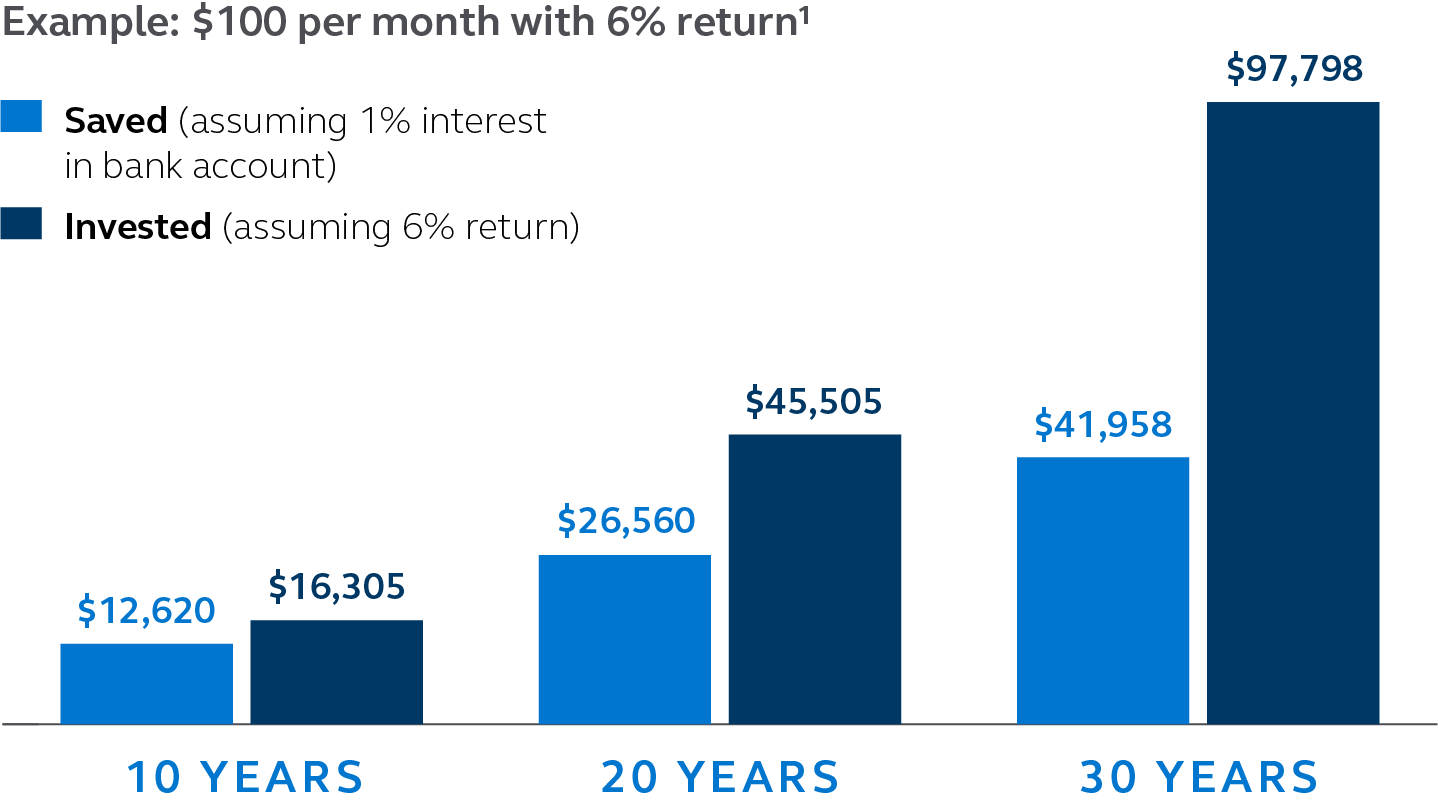

How much will I have if I invest $100 a month for 10 years : But by depositing an additional $100 each month into your savings account, you'd end up with $29,648 after 10 years, when compounded daily.

How much will I earn if I invest $100 a month

Investing $100 per month, with an average return rate of 10%, will yield $200,000 after 30 years. Due to compound interest, your investment will yield $535,000 after 40 years. These numbers can grow exponentially with an extra $100. If you make a monthly investment of $200, your 30-year yield will be close to $400,000.

What happens if you invest $100 a month for 5 years : You plan to invest $100 per month for five years and expect a 6% return. In this case, you would contribute $6,000 over your investment timeline. At the end of the term, your portfolio would be worth $6,949. With that, your portfolio would earn around $950 in returns during your five years of contributions.

10 best ways to turn $100 into $1,000

- Opening a high-yield savings account.

- Investing in stocks, bonds, crypto, and real estate.

- Online selling.

- Blogging or vlogging.

- Opening a Roth IRA.

- Freelancing and other side hustles.

- Affiliate marketing and promotion.

- Online teaching.

Invest $100 per week in dividend stocks

So, if you invest $100 a week, your equity portfolio would balloon to $5,200 in a year and $26,000 in five years. To earn $1,500 in annual dividend income, you would need to find stocks offering shareholders an average yield of 5.8%.

How much should a 30 year old have saved

If you're looking for a ballpark figure, Taylor Kovar, certified financial planner and CEO of Kovar Wealth Management says, “By age 30, a good rule of thumb is to aim to have saved the equivalent of your annual salary. Let's say you're earning $50,000 a year. By 30, it would be beneficial to have $50,000 saved.The Ideal Number

| Age | Income | Net Worth |

|---|---|---|

| 20 | $25,000 | $50,000 |

| 25 | $35,000 | $87,500 |

| 30 | $50,000 | $150,000 |

| 50 | $55,000 | $275,000 |

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

If you invest $10,000 and make an 8% annual return, you'll have $100,627 after 30 years. By also investing $500 per month over that timeframe, your ending balance would be $780,326.

How to turn 100k into 1 million : If you keep saving, you can get there even faster. If you invest just $500 per month into the fund on top of the initial $100,000, you'll get there in less than 20 years on average. Adding $1,000 per month will get you to $1 million within 17 years. There are a lot of great S&P 500 index funds.

What happens if you save $100 dollars a month for 40 years : Your Retirement Savings If You Save $100 a Month in a 401(k)

If you're age 25 and have 40 years to save until retirement, depositing $100 a month into a savings account earning the current average U.S. interest rate of 0.42% APY would get you to just $52,367 in retirement savings — not great.

How much is $500 a month invested for 10 years

Here's how a $500 monthly investment could turn into $1 million

| Years Invested | Balance At the End of the Period |

|---|---|

| 10 | $102,422 |

| 20 | $379,684 |

| 30 | $1,130,244 |

| 40 | $3,162,040 |

17.12.2023

-1697563761.png)

Key Points. The Vanguard Growth ETF is one of many great growth-oriented funds that can deliver market-beating returns. If you can invest $200 per month for 30 years, thanks to the power of compounding, you could end up with a portfolio of more than $1 million.Investing $100 per month, with an average return rate of 10%, will yield $200,000 after 30 years. Due to compound interest, your investment will yield $535,000 after 40 years. These numbers can grow exponentially with an extra $100. If you make a monthly investment of $200, your 30-year yield will be close to $400,000.

How to invest $100 dollars for quick return : What are some low-risk ways to invest $100

- High-yield savings accounts. Compared to traditional savings accounts, these accounts offer higher interest rates, which can help your money grow faster.

- Certificates of deposit (CDs).

- Treasury bonds.