Antwort Is a Business account on PayPal free? Weitere Antworten – Are PayPal business accounts free

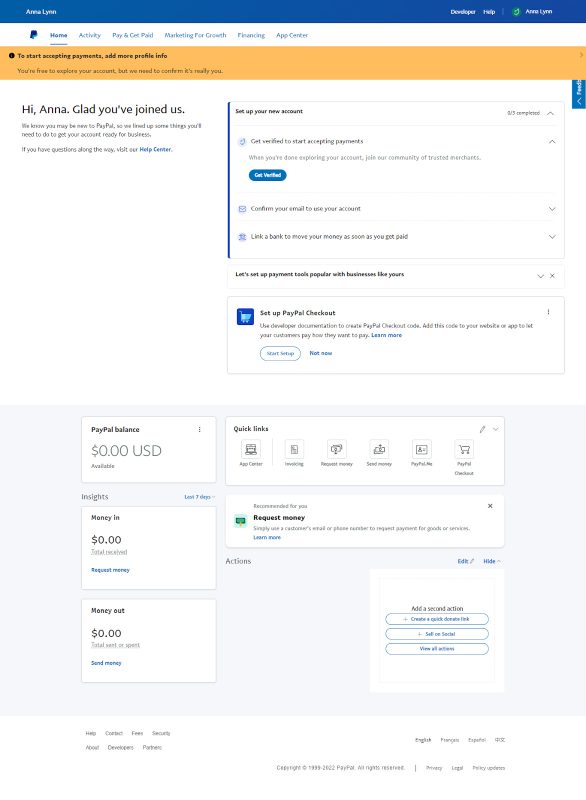

How much does it cost to open a PayPal Business Account It's free to sign up for an account. PayPal merchant account fees only apply to transactions—which means you only start paying when you start selling. There are no set-up costs, monthly fees, or cancellations fees.Overall, whether or not a PayPal Business Account is right for you depends on what your business needs are. If you're looking to accept payments from customers and don't need the extra features that come with a personal account, then a PayPal Business Account might be the right choice for you.To open a Business account, you'll need to provide your full legal name, email address, a password, your tax ID or social security number (SSN), business description, and your business bank account details.

How to change from PayPal business to personal :

- Click on the “Profile” tab in the top-right corner.

- Click on “My Account” at the bottom of the page.

- Click on “Update Account Info” in the bottom left corner.

- Enter your new information and click “Change Account Type.”

How do I avoid PayPal fees for my business account

Registering your bank account

Using the funds in your PayPal account helps avoid processing fees. Any funds received will be sent to your bank account via instant transfer. The transaction amount is entirely up to you and there is no fee for receiving money from your PayPal account in your bank account.

How do I avoid PayPal business fees : There are several ways to avoid PayPal fees as a business.

- Setup A Business Account. By setting up a business account through PayPal you will have reduced fees.

- Request To Be Paid As “Friend or Family”

- Apply For Lower Fees.

- Deduct PayPal Fees From Your Tax Returns.

- Use a PayPal Alternative.

Despite the benefits, businesses should be aware of PayPal transaction fees, account freezes, lack of customization options, high currency conversion fees, and the possibility of chargebacks.

PayPal is free for online and in-store consumer transactions without currency conversion. For commercial transactions for merchants, PayPal charges fees that are a percentage of the amount (ranging from 1.90% to 3.49%) plus a fixed fee per transaction.

What are the disadvantages of a PayPal Business account

Drawbacks to using PayPal

- High chargeback fees.

- Higher fees than a typical merchant (credit card processing) account.

- Account suspension for terms and conditions (T&C) violations that can freeze your funds for months.

- May take 2 business days to get your money.

- Customer service can be hard to reach.

To stay in business, the company needs to make some form of income off of its services. To do this, PayPal charges a fee for most transactions that go through its system. And in most cases, these fees are charged to the person or company receiving the money.There are two kinds of accounts when you use PayPal: Business and Personal. A Business account is for business owners or merchants and has lots more features for business owners. PayPal Personal is for those who are looking to shop online safely, get paid online securely, or easily divide bills.

If you close your PayPal account, it will be permanently closed. Be sure to record the bank account you linked your PayPal Business Account to so you can easily set up your next payment account. Because you can't reopen your account, your entire transaction history will be deleted.

Does PayPal business cost anything : It's free to open an account; you only pay transaction fees when your customers pay you.

Does PayPal charge a fee for business account transactions : PayPal is free for online and in-store consumer transactions without currency conversion. For commercial transactions for merchants, PayPal charges fees that are a percentage of the amount (ranging from 1.90% to 3.49%) plus a fixed fee per transaction.

What happens if I make my PayPal a business account

Business Account

Operate under a company/group name. Accept debit card, credit card, and bank account payments for a low fee. Allow up to 200 employees limited access to your account. Access PayPal products such as PayPal Checkout.

PayPal calls these Personal and Business accounts. Personal PayPal accounts are best for those who like to shop or get paid online or to split bills between more people. Business accounts are ideal for merchants or businesses and offers additional features for them.How much is the PayPal fee for $100 For the most common PayPal fee of 3.49% + $0.49, the fee for a $100 transaction will be $3.98, making the total money received after fees $96.02. Example 1: You send an invoice to a client for $500 to be paid via PayPal Checkout or Guest Checkout.

How do I avoid PayPal fees : How to avoid PayPal fees

- Use the "Friends and Family" option. When sending money through PayPal, you have the option to use the 'Friends and Family' category instead of 'Goods and Services'.

- Receive payments in the same currency.

- Offer local pickup or delivery options.

- Use other payment methods if possible.